Daniel Berlind

Executive ChairmanIn this article

You may think of fraud as something that only happens to big businesses or wealthy individuals, but the truth is that it can happen to anyone, anywhere. In fact, some cities in the United States are more vulnerable to application fraud than others, and it’s important to be aware of these hotspots if you want to protect yourself.

In this blog, we’re going to take a look at the top 20 US cities for application fraud, how this type of fraud occurs, and most importantly, what you can do to prevent it from happening. So buckle up and get ready to learn how to keep your personal information safe from those who would use it for their own gain.

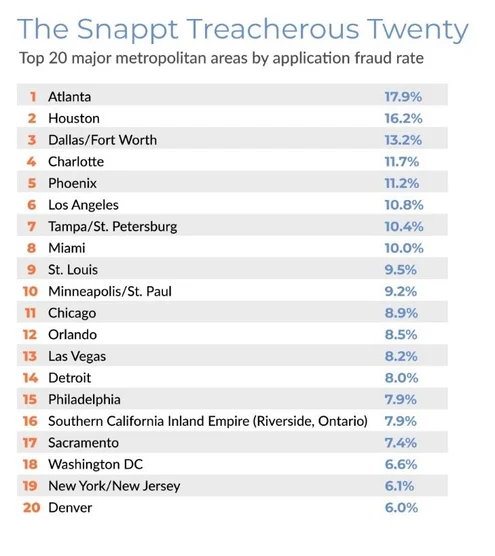

The Treacherous Twenty

Application fraud has risen drastically in recent years. Scammers are becoming increasingly skilled at altering bank statements, falsifying pay stubs, and creating false rental histories. Although application fraud is on the rise nationwide, certain areas have a higher concentration of scammers than others.

Snappt has scanned over 1.5 million pay stubs and bank statements and has recently developed this list to warn property managers of the highest risk areas. Eviction rates, often driven by rental property application fraud, reached as high as 1 in 9 for our treacherous twenty list. The average eviction rate was 4.83%, nearly double the national average of 2.6%.

What is Driving Application Fraud?

What are the driving factors behind this risky act? Firstly, the rising rents across the nations haven’t made the rental landscape any easier for tenants. Higher rent rates make it difficult to qualify for an apartment, leading applicants to make desperate decisions and alter their documents.

Unemployment can make this situation worse, too. Unemployment rates were as high as 5.7% on our list, well above the national average of 3.8%. In fact, half of the metro areas on our list have unemployment rates at or above the national average.

Next, let’s talk about the allure of prime real estate. Tenants are on the hunt for a fantastic unit that not only suits their needs but serves as a bragging right to friends and family. People are willing to go to great lengths to secure a coveted spot, and that’s where the temptation to commit rental application fraud comes in.

Next, we have unfortunate financial troubles. Money, or rather the lack thereof, can make even the most honest soul contemplate some less-than-savory schemes. Are rent prices soaring like a rocket? Is your income not as high as you need it to be? Well, if you can’t afford the rent, why not embellish your financial situation on that application? A simple switch of a number can make it look like a tenant makes much more than they actually do.

With the advent of digital everything, it’s become easier than ever to forge documents and manipulate information. Photoshop skills, coding expertise, or the simple ability to Google a company that possesses those skills can make the actual act of committing fraud much easier. With these tools at their disposal, fraudsters can easily weave a web of deceit.

We surveyed 100 property managers across the country to get their insight on the recent rise in application fraud:

- 85% said it was due to the increasing prevalence of general fraud in our society.

- 85% said that the ease with which false documents can be obtained online by apartment applicants is a concern today.

- 78% cited the rise in rents, and the pressure it puts on prospects to “stretch” on their applications.

- 75% pointed to eviction moratoriums being somewhat or extremely significant as contributing factors.

- 70% said the COVID-19 pandemic was a significant driver.

- 66% ranked less in-person contact with applicants, the growing sense of anonymity in society, in the same way.

The Importance of Tenant Screening

With the rise of document fraud on every property manager’s mind, they’ve reexamined how they screen tenants. Common issues they’ve reported include:

- Fair housing violations

- The screening process isn’t thorough enough and isn’t catching bad tenants

- Tenant screening is requiring too much time from staff

- Altered financial documents are hard to catch

They’re aware that knowing how to screen tenants is a critical part of running a successful property management business, but struggle to make it as efficient and seamless as it could be. Remember that survey we took with 100 property managers? Well, we also asked them what the most time-consuming parts of the process were. The top three areas were verifying bank statements (72%), verifying pay stubs (67%), and checking references (67%).

Those three areas were also deemed the most important steps of the process. 90% of respondents said that verifying the accuracy of a paystub was somewhat or extremely important. Nearly the same amount (89%) said authenticating an applicant’s bank statement in the same tier. Verifying an applicant’s ID – i.e., confirming the person is who they say they are – was seen as the most critical step in the process, with 92% of respondents ranking it first.

Solutions to Application Fraud

So what can be done about this pesky problem? Implementing Snappt’s AI-enabled fraud detection is a great start. Our software can scan the computer code within the PDF documents of pay stubs and bank statements to see if they have been altered. Using this solution to target two of the three most critical aspects of application screening can reduce the hours staff spend screening documents to minutes.

On top of that, level up your application process by requesting two months of pay stubs or bank statements. Legitimate renters will be happy to oblige, but scammers will be forced to sweat under the pressure and give you more intel to make an informed decision. With this added layer of security, you’ll keep those fraudsters at bay and make it harder for them to slip through the cracks.

Keep an eye out for inconsistencies between the dates on issued pay stubs and deposited funds. While weekends and holidays can throw things off by a day or so, it’s rare for it to happen month after month.

Give employers a call to verify that your applicant works where they say they do. Don’t just rely on the number submitted with the application. Do a quick online search and find the number listed on the company’s website for an extra layer of security. While some employers may not be keen to share salary specifics, it never hurts to ask and make sure everything checks out.

Encourage your team to prioritize legitimate renters by tying future bonuses to a property’s on-time rent payment score, rather than just the number of new leases approved. This will ensure that your team prioritizes quality over quantity when approving applications and motivates them to remain vigilant in identifying any suspicious activity.

My City Isn’t on the List. Am I Safe?

Didn’t make the list? Congratulations! But are you safe? Let’s do the math.

Let’s start with your fraud rate. The average application fraud rate for major metro areas that didn’t make the list was 3.6%.

Next, assume you have 250 units. A typical client sees perhaps 150 units come up for rent each year. At a 3.6% fraud rate, that means you’ll receive 5 to 6 fraudulent applications. Will you be able to spot these? Probably not – they are virtually invisible to the naked eye.

So now you have five potential bad tenants in your building. Nationally, it costs $7,500 to evict someone (legal fees, lost rent, damage, etc.). So, your exposure is 5 x $7,500 = $37,500.

Are you safe? Well, $37,500 per year is a significant number. And remember, Snappt costs $18 per year per unit to keep these fraudsters out of your property. For a 250-unit property, that’s $4,500/year to avoid a $37,500 exposure.

To Sum Up…

Rental fraud may be on the rise, but that doesn’t mean your team has to suffer. By staying informed and implementing a few key security measures, you can keep yourself and your property safe from fraudsters’ clutches. Always remember to trust but verify an applicant’s information, stay vigilant for red flags such as a lack of documentation or inconsistent payment histories, and encourage your team to prioritize authenticity over quantity when it comes to leasing.

Chat with our sales team to learn about our comprehensive fraud solution