Effects of COVID-19 on Residential Rentals

2020 Survey Report

Residential rentals are at risk

With U.S. unemployment rates at historic highs, we wondered, how is this impacting the residential rental market? To find out what effect the pandemic is having on the residential rental market, Snappt commissioned the 2020 Effects of the COVID-19 Pandemic on Residential Rentals Survey.

This survey focuses on financial document application fraud (altered bank statements, fake pay stubs, etc.) and the connection to evictions within rental portfolios. We surveyed property managers who either manage or are directly involved with evaluating rental applications and renters split among Millennials, Gen-Xers, Boomers and the Silent Generation.

Key Survey Finding

Renters and properties are struggling.

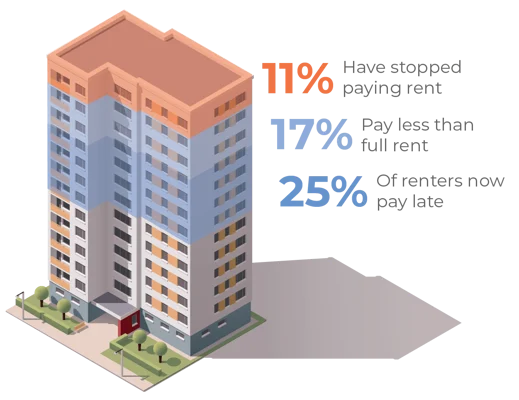

Tenants are struggling to pay rent.

Property Managers report that 53% of tenants are having trouble making rent. In fact, 25% of tenants are paying late, 17% now pay less than full rent, and 11% have stopped paying at all. Additionally, the number of renters paying rent by credit card is soaring. Is this an indicator that these renters are near the end of their financial ropes?

Evictions are stacking up

Property Managers report an astounding 21% eviction rate today, a 75% increase from last year. One in four of these are tied to application fraud. Three of ten renters have been or will be evicted after moratoriums expire. In fact, the typical property manager has 15 evictions stacked up waiting for moratoriums to expire.

Key Survey Finding

Financial difficulty leads to application fraud.

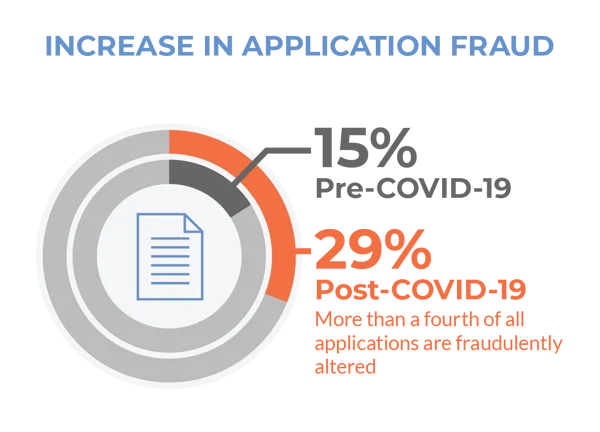

Rental application fraud is on the rise.

Did you know that more than a fourth of the financial documentation within rental applications are fraudulently altered? This includes fake pay stubs, altered employment records, and other financial documents are being falsely presented as legitimate during the rental applications process. These types of financial document fraud a difficult to detect, especially when submitted via an online application.

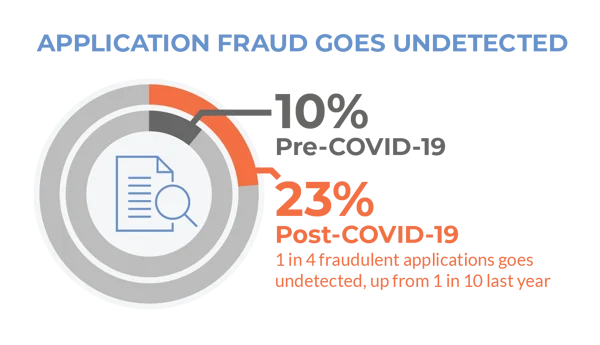

Financial documentation fraud leads to more evictions.

Altering application documents is easy with everyday technology like high-quality scanners and photo-editing software. Although it’s easy to commit, it’s difficult to detect. Unfortunately, this leads to applications with inaccurate information which makes tenant screening riskier than ever before.